PIN » Probability » Risk |

Why are some people willing to buy lottery tickets, but at the same time insure themselves against theft, death, or property damage? The cost of a lottery ticket is substantially more than the average winnings one can expect to get. On the other hand, the premium we pay for insurance is substantially greater than the average cost of claims.

People differ in how much they are willing to take risks, and what kind of stakes they consider. A lottery ticket costs only a dollar, and has little impact on our lifestyle, while the potential multi-million dollar payoff would impact our lives greatly. Paying a thousand or two thousand dollars in insurance premiums for a house or car is costly, but perhaps is worthwhile if it excuses us from the unlikely but costly lawsuits resulting from our causing injury.

Economists often express one's willingness to take risks through a utility function of money. To understand the notion of "utility over money," consider the following illustration. A "prize patrol van" pulls up in front of your house. When you open the door, the representative of the state lottery announces that you have won one million dollars. Now imagine the same scenario, only you are told that you have won two million dollars. Winning a million dollars probably makes you very happy. Winning two million also makes you happy, but not twice as happy as one million dollars.

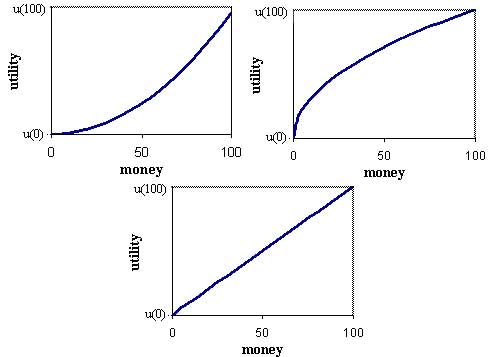

Consider the following utility function (graphs in the left side of this page).

The horizontal axis represents the amount of money a person has, and the vertical axis represents "utility" or how much that money is worth to us. Note that the utility function is convex (loosely, this means that it increases slowly initially, and then faster). What does this utility function say about risk? It implies that a person is risk-seeking, or likely to take gambles (buy lottery tickets or play blackjack at the casino). To see why, consider a poor college student with a $2 bank balance at the end of the month, the day before $100 in rent is due. If the student gave up a dollar, his condition would be little changed. His "utility" of one dollar or of two dollars is almost the same, since neither is enough to pay the rent. However, $100 is worth substantially more to the student. Therefore, he may be willing to buy a lottery ticket with one or both of his two dollars, thinking "even if I lose, I am still in trouble with the landlord, but if I win, I am saved!"

The second graph in the picture illustrates an utility function which is concave. It increases quickly initially and then flattens out. This implies that money, initially, is more valuable than additional sums of money once we are already rich. The utility function represents a person who is risk-averse or prefers not to take risks.

A third type of utility function is represented by the third graph.

This utility function simply represents that every dollar is worth to us

as much as every other. Such a person is deemed risk-neutral

Next : Certainty

Previous : Odds