2. Rangpur

3. Rajshahi

4. Bogra

5. Tangail

6. Mymensingh

7. Sylhet

8. Dhaka

10. Khulna

11. Faridpur

12. Patuakhali

13. Comilla

14. Noakhali

15. Chittagong

A. Bhola

B. Hill Tracts

The Grameen Bank

After the War of Independence, Dr. Muhammad Yunus returned to his native Bangladesh from the United States and became the chairman of the Department of Economics at Chittagong University. Yunus stepped out from his theoretical economic models to interact directly with the local rural poor to find out what their needs were. He discovered that the poor often knew exactly what they needed in order to start or build successful business and agricultural activities, but they lacked access to the credit to make the initial investment.

The poor have a large need for credit to buy assets that will build their potential for income and to cover their needs during emergencies such as illness and drought. In 1987, 59% of all households who borrowed money were poor. Their average credit amount was 537 taka, compared with 16,507 taka borrowed by the average rich borrower. (Bangladesh Bureau of Statistics, 1989) The poor depend upon professional money lenders for credit because traditional banks demand collateral to obtain loans and do not offer small loans (less than $100US). These money lenders wield strong bargaining power over their poor customers and are able to charge interest rates of 20% per month, which are higher rates than those paid by the rich for commercial bank loans.

Yunus discovered this strong need for credit and approached the local banks to extend loans. After being rejected by the banks, Yunus lent his own money to the local poor. Heartened by the high payback rate of his borrowers and the economic impact it had on their lives, he institutionalized the practice by creating the Grameen Bank. The Grameen Bank's mission is to eradicate poverty using the tool of microcredit (small loans made to the poor).

The Grameen Bank has achieved a payback rate of 98% by using "social capital" to ensure the successful payback of loans. Loans are distributed to Grameen Bank members through groups. Groups are made up of 5 or 6 members and have the power to decide whether to allow a new member into their group and whether to approve a new loan for one of the members. Each group member has an incentive to evaluate proposed loans carefully because the renewal of their own loans depends upon the successful payback of loans by all group members. The groups acts as an effective filter for loan approval and then provides both support and peer pressure to ensure that loans are paid back once extended. Social capital is the set of close relationships found among rural villagers. The success of microcredit thus depends on the social capital that binds members together and ensures payback.

The Grameen Bank extends loans at the same rate as commercial loans. These loans are typically used to enhance agriculture and entrepreneurial pursuits that range from husking rice and repairing radios, to manufacturing brooms and selling saris. In addition to the standard loans, Grameen Bank members are required to save 1 taka per week. There is also a Group Loan fund that each member must contribute to. The Group Loan fund is loaned out to cover short-term loans for group members. Both the required savings and the Group Loan fund provide members with the financial reliance to survive through tough times. (Bornstein, 1996)

Exhibit 19 - Grameen Bank Zones, 1998

Decision making at the Grameen Bank is very decentralized, yet it maintains a clearly hierarchical organization structure shown below. This structure, defined in the early 1990s, allows for a total of 2,700,000 members = (1 X 15 X 10 X 10 X 60 X 6 X 5). Grameen operates in 15 zones and does not currently have operations in Bhola or the Hill Tracts.

The Grameen Bank has defined a subset of the population that it targets for its membership. Setting this target helps it maintain its organizational effectiveness and achieve its goals of eradicating poverty. (Bornstein 1996)

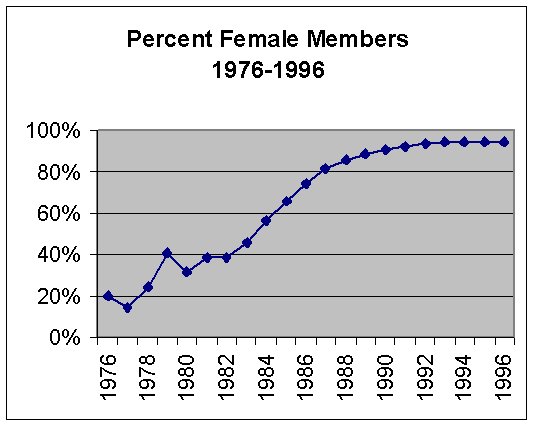

Exhibit 20 - Percent Female Members

Early on, Grameen decided it could have the greatest impact by making loans to women. Women are more likely than men to invest money in ways that will provide food, clothing, and shelter for their families. Women feel the effects of poverty more acutely than do men, and landless women are the group most unlikely to have access to loans from other sources. In order to effectively target women as members Grameen has had to create mechanisms to ensure that the loan money is not simply passed on to their husbands. The Grameen Bank has steadily recruited more women as members and today has a membership that is 94% women.

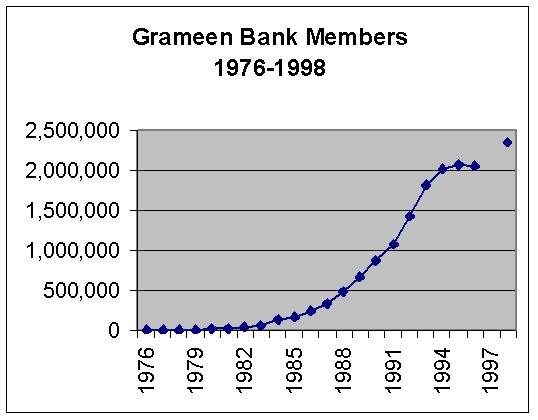

Exhibit 21 - Grameen

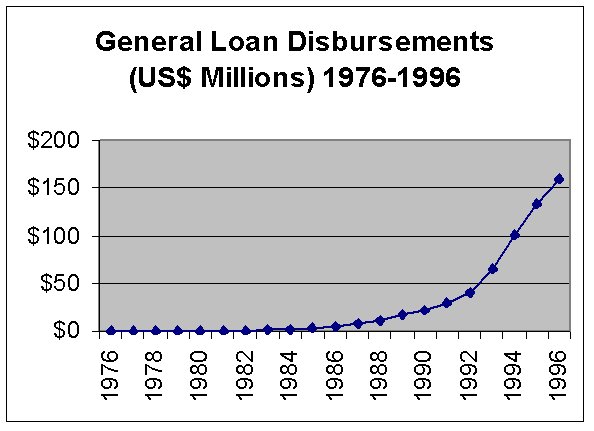

Membership Exhibit 22 - Loan

Disbursements Exhibit 23 -

Grameen Members, 1998

The growth of the Grameen Bank has followed an exponential pattern. The biggest constraint to growth in the earlier years was the training of new employees. Training lasts six months, 90% of which is done in existing Grameen centers. The number of new employees and thus new centers was restricted by the number of existing centers, creating the constraint of slow exponential growth in the early years. (Bornstein, 1996)

After growing slowly during the late 1970s and early 1980s, the Grameen Bank rapidly grew during the late 1980s and early 1990s. Today it is the largest non-governmental organization in Bangladesh with over 2 million members throughout the country. Grameen has administered over $2.5US Billion in loans throughout its history.

Exhibit 24 - Centers per

Village Exhibit

25 - % Households with Grameen Members

Note: These schematic maps use Grameen member/center

information from 1998 and household/village information from

1991. These maps illustrate the relative geographic

presence of Grameen rather than to indicate an accurate level of

penetration into the population.

Exhibit 26 - Analysis of Member Penetration

In 1991, Yunus decided to slow the growth of Grameen's membership and focus instead on expanding the variety of services Grameen provides for its members. This slowing of growth is understandable when one estimates the reach of the Grameen Bank into its target population. The organizational structure he designed for Grameen accomodates up to 2,700,000 members but is now almost at full capacity (1998 membership is 2,322,736). Grameen already averages more than one center per village in almost half of the zones in which it operates (but see note above). On average, there are almost two Grameen centers for every three villages. The Grameen Bank has reached a critical mass of members, and it cannot continue its growth indefinitely.

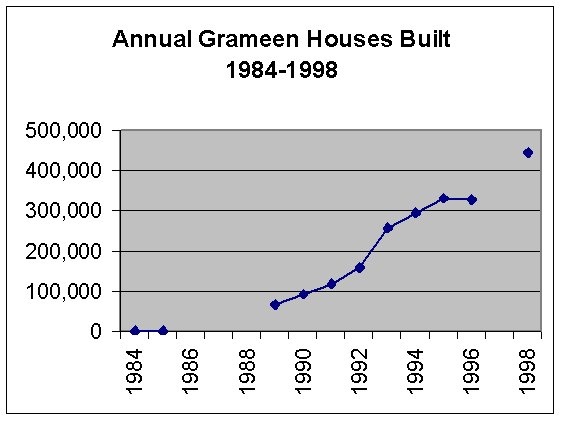

Exhibit 27 - Houses Built w/ Grameen Loans

With the now extensive reach of the Grameen Bank, Yunus has realized that he can do more to alleviate poverty by expanding services offered to current members than by pushing for continued expansion. Through these new services and businesses, Grameen is growing into a family of organizations with the Grameen Bank at its center. In addition to growing economic opportunities for the poor in traditional activities such as weaving cloth, the Grameen Family of Organizations is using market mechanisms to bring high-tech infrastructure into rural Bangladesh. These new services and businesses are listed in the exhibit below with the year in which they were started.

Exhibit 28 - Additional Services Provided by Grameen Family of Organizations